Investing in OzBargain’s Top 10 Most Popular Retailers

While there are numerous ways to invest your money in the stockmarket, perhaps you can try the OzBargain method. We took the top 10 most popular OzBargain stores and measured how well you would do with a 1 year investment.

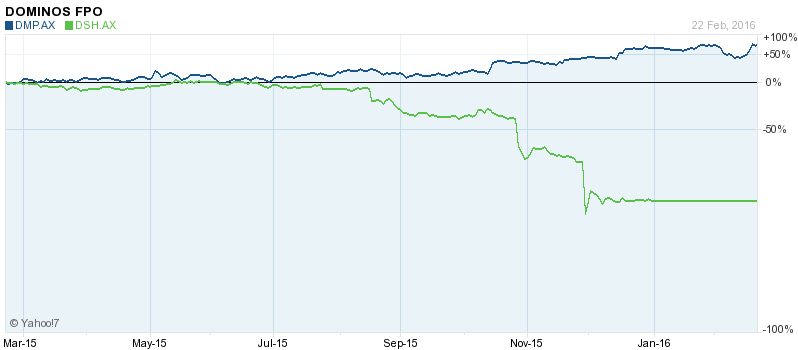

The two standouts are Dick Smith for completely collapsing which resulted in an 83% negative return (well probably 100% is more accurate). On the other end, Dominos has absolutely killed it with a 130% gain in value. Overall, a 20% return on investment is a fairly good effort however this is a good lesson in diversifying your portfolio to hedge your losses.

| Store | Price (2/1/15) | Price (4/1/16) | Value (2/1/15) | Value (4/1/16) | # of Shares | Change |

|---|---|---|---|---|---|---|

| Dick Smith | $2.10 | $0.36 | $999.60 | $171.36 | 476 | -82.90% |

| Woolworths/ Big W / Dan Murphy’s / Masters (Woolworths) | $30.49 | $24.40 | $1,006.17 | $805.20 | 33 | -19.36% |

| Apple | $111.39 | $102.61 | $1,002.51 | $923.49 | 9 | -7.63% |

| Target/Coles/Officeworks (Wesfarmers) | $41.78 | $41.66 | $1,002.72 | $999.84 | 24 | -0.02% |

| Harvey Norman | $3.36 | $4.19 | $1,001.28 | $1,248.62 | 298 | +24.83% |

| Amazon | $312.58 | $656.29 | $937.74 | $1,968.87 | 3 | +103.32% |

| JB Hi-Fi | $15.76 | $19.40 | $992.88 | $1,222.20 | 63 | +22.38% |

| Google (Alphabet) | $532.60 | $762.20 | $1,065.20 | $1,524.40 | 2 | +49.23% |

| Dominos | $25.20 | $57.80 | $1,008.00 | $2,312.00 | 40 | +130.16% |

| Myer | $1.40 | $1.20 | $1,000.00 | $857.14 | 714 | -14.29% |

| Total | $10,016.10 | $12,033.12 | +20.30% |

Notes:

- Share prices were the opening price on January 2, 2015 and January 4, 2016 (first trading days of the year).

- Top 10 is derived from publicly traded companies. The Good Guys, Shopping Express and I Want That Flight are not publicly traded companies.

- Stores that were owned by the same parent company like Woolworths were only counted as one entity.

- Since you can only buy full shares and not a fraction of a share, the closest amount of shares to make up $1,000 was selected.

- For simplicity, there was no currency conversion for US traded stocks: Apple, Google and Amazon.